[ad_1]

What’s a mattress financial institution?

A mattress financial institution is a business-to-business (B2B) journey supplier that connects accommodations with journey distributors, similar to on-line journey businesses (OTAs) and tour operators. Serving as intermediaries within the journey trade, mattress banks allow accommodations to extend occupancy with out immediately managing complicated distribution channels.

By collaborating with mattress banks, accommodations achieve entry to worldwide markets and various journey audiences. For example, a resort in Australia would possibly use a mattress financial institution to market rooms to European journey brokers, considerably increasing its international attain with out the necessity for direct worldwide advertising.

How does the idea of a mattress financial institution work?

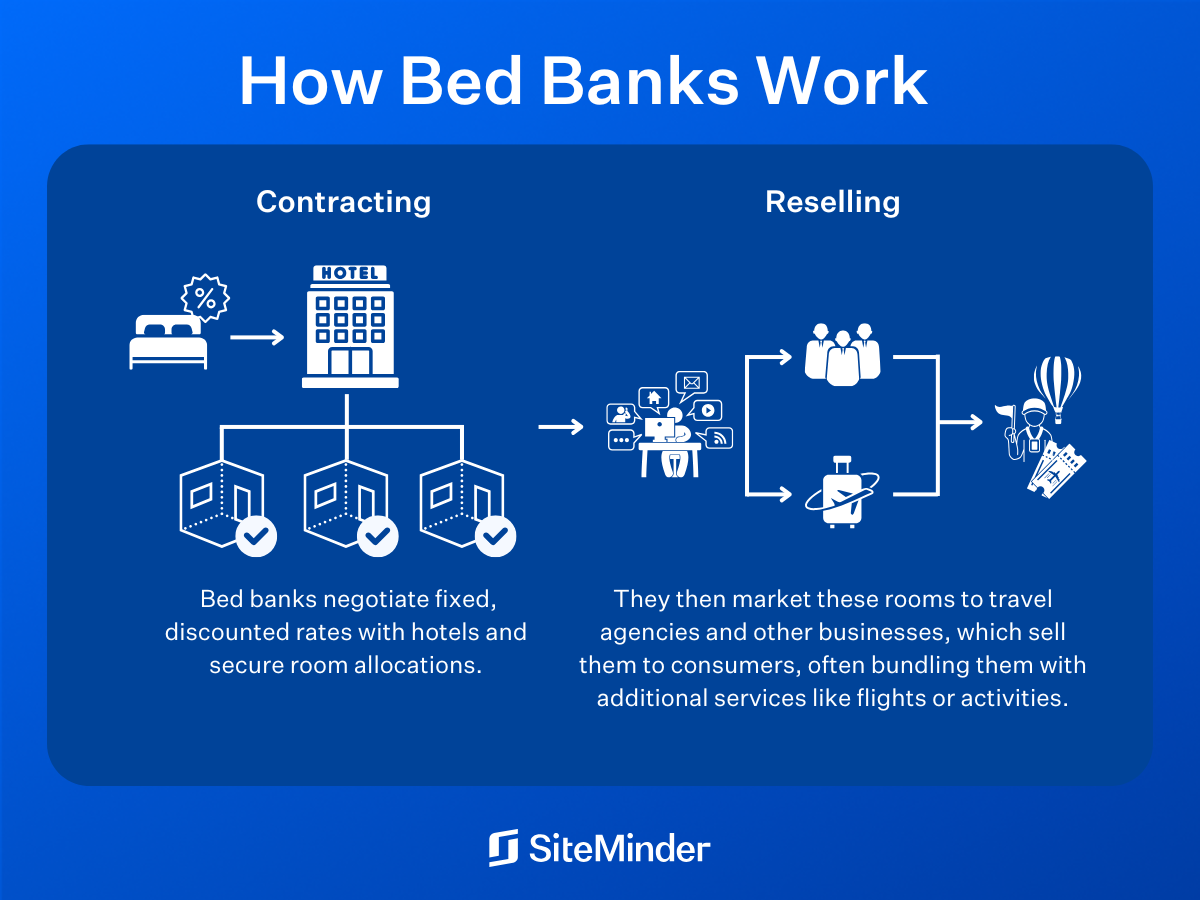

Mattress banks function by buying massive room allotments from accommodations at a reduced bulk fee. These rooms are then resold to varied journey distributors, similar to OTAs, tour operators, and journey brokers, who then supply them to finish customers. This mannequin helps accommodations fill rooms which may in any other case stay vacant, thereby bettering total occupancy charges without having in depth advertising efforts or partnerships with a number of distributors.

Within the B2B journey sector, mattress banks play a pivotal function by serving as a bridge between accommodations and distributors, enabling environment friendly room stock administration and broader market attain. Mattress banks negotiate contracts with accommodations for particular room blocks, making certain a gradual provide for distributors. In flip, distributors profit from pre-negotiated charges and availability, which they will supply to their shoppers.

For instance, a medium-sized resort in a tourist-heavy area would possibly accomplice with a world mattress financial institution to safe publicity throughout a number of worldwide markets. The mattress financial institution distributes the resort’s stock to varied OTAs and journey brokers worldwide, attracting company who won’t have discovered the resort by way of direct channels.

This weblog will inform you the whole lot you have to learn about mattress banks, together with how one can get linked to them and develop your resort’s income.

Why ought to accommodations use the most important mattress banks?

Partnering with well-established mattress banks, similar to Hotelbeds, can supply vital benefits for accommodations looking for to broaden their market attain. Massive mattress banks have in depth international networks and established relationships with main journey distributors, making it simpler for accommodations to attach with a broader viewers.

Along with increasing visibility, partnering with main mattress banks helps accommodations faucet into area of interest markets, similar to company journey and specialised tour operators. By diversifying their distribution channels, accommodations can scale back dependency on direct bookings and guarantee a gradual stream of income.

Faucet into new distribution alternatives

With SiteMinder, you’ll be able to simply automate room stock and fee updates out of your most popular mattress financial institution operators to your PMS, boosting your effectivity and income.

Advantages of partnering with a world mattress financial institution

Partnering with a world mattress financial institution can unlock vital progress alternatives for accommodations by offering broader market entry and enhanced income potential. Under are some key advantages to think about:

1. Increase your resort’s visibility and attain area of interest markets

Partnering with a world mattress financial institution opens doorways to untapped worldwide markets and area of interest audiences. Inns can achieve publicity on platforms that cater to particular sorts of travellers, similar to luxurious vacationers or journey vacationers, with out the necessity for direct advertising efforts.

2. Enhance bookings and total resort income

Mattress banks assist your resort fill unsold stock, particularly throughout low seasons. By providing rooms to a wider viewers by way of numerous journey distributors, accommodations can keep larger occupancy charges year-round and improve total income.

Mattress financial institution checklist: Who’re the key resort mattress banks?

A number of key gamers dominate the mattress financial institution trade, every providing distinctive providers and advantages for resort companions. Under is an inventory of a number of the main mattress banks:

- Hotelbeds. Hotelbeds is among the largest and most outstanding mattress banks, offering entry to a world community of journey distributors. Their platform presents superior instruments for stock administration and dynamic pricing.

- WebBeds. WebBeds is thought for its in depth attain and aggressive fee constructions. They cater to a variety of journey distributors, from OTAs to offline journey businesses.

- Travco. Travco specialises in offering accommodations with entry to worldwide tour operators and wholesalers, making certain broad market protection.

- Bonotel. Bonotel focuses on luxurious and boutique accommodations, providing tailor-made providers for properties aiming to draw high-end vacationers.

- HotelsPro. HotelsPro presents a sturdy platform for managing room allotments and pricing, with a give attention to real-time availability and seamless integration.

Is Hotelbeds a Mattress Financial institution?

Sure, Hotelbeds is among the most established mattress banks within the trade, providing in depth distribution networks and superior expertise options for accommodations.

Is Expedia a Mattress Financial institution?

No, Expedia just isn’t a standard mattress financial institution. Whereas it operates as an internet journey company, it collaborates with mattress banks to supply resort stock.

Tricks to maximise the aim of a mattress financial institution for accommodations

1. Assess the situations of mattress financial institution partnerships

Earlier than signing a contract with a mattress financial institution, you have to rigorously consider the phrases and situations, together with fee charges, fee schedules, and cancellation insurance policies. This varies from mattress financial institution to mattress financial institution considerably, so examine the high quality print.

2. Steadiness mattress financial institution bookings with direct and different sources

Whereas mattress banks can considerably enhance occupancy, over-reliance on third-party distributors could have an effect on profitability. You must purpose for a balanced mixture of direct bookings and third-party partnerships – although clearly with direct bookings, you retain extra of your income.

3. Observe and measure mattress financial institution efficiency

Utilizing efficiency metrics, similar to income per accessible room (RevPAR) and reserving lead time, can assist you assess the effectiveness of their mattress financial institution partnerships and make data-driven selections on whether or not to stay partnered or search options elsewhere.

4. Join mattress banks with current tech stack

Integrating mattress banks with property administration programs (PMS) and channel managers ensures seamless updates of room charges and availability, decreasing handbook workload and minimising errors.

[ad_2]