[ad_1]

The wave of live performance bulletins by worldwide music acts this 12 months has stirred pleasure not simply amongst followers, however hoteliers. The mad rush for tickets to see the likes of Coldplay, Oasis and Kylie Minogue has triggered a pointy demand for resort rooms wherever these artists are performing. And, this phenomenon has prolonged past concert events. Main public gatherings just like the photo voltaic eclipse viewing within the US and sporting occasions just like the UEFA Euro in Germany have additionally drawn important consideration to lodges, as native and worldwide travellers flock to attend these occasions.

Occasion-driven journey is undeniably booming, with its affect seen in resort occupancy and room charges. As Allied Market Analysis experiences, the worldwide occasions business is projected to succeed in US$2 trillion by 2032 – practically doubling its 2019 measurement of US$1.1 trillion – suggesting that occasions are set to change into an much more necessary income supply for the hospitality business.

Whereas occasions have lengthy been a dependable driver of resort bookings, their rising significance within the hospitality business is now being pushed by shifting dynamics of provide and demand. As Fabian Bartnick, Founding father of income administration options Infinito and PerfectCheck, factors out: “Everyone is now seeking to monetise occasions … and somebody is controlling their provide.” In different phrases, key gamers – be it governments, airways or occasion organisers – now play an important function in deciding when, the place and the way occasions occur and are made obtainable, usually creating shortage amid rising demand.

Citing the Singapore leg of Taylor Swift’s Eras Tour for example of managed shortage, Bartnick explains how the native authorities successfully managed the availability of Swift’s live performance in Southeast Asia by securing an unique contract with the artist, creating a novel market the place the occasion’s restricted availability enabled different enterprise sectors to cost larger costs.

“You and I’d assume $700 for a ticket is loopy,” says Bartnick. “However if you’re a Swifty residing in Thailand or the Philippines and have the possibility to see her in your yard, you’re going. So, your complete spectrum of income administration that’s taking place [for events] has widened from simply ticket gross sales. Airways and lodges have capitalised on the development.”

Altering attitudes to journey

The rise of occasion journey can also be carefully linked to the inflow of travellers arriving en masse at these occasions, as seen with Swift’s tour. Bartnick notes that this shift factors to a deeper change in attitudes in the direction of journey, the place customers are more and more prioritising life-enriching experiences.

“After Covid, there was a basic shift in what it truly means to have a sure form of freedom, to have a sure potential to journey, see the world and do one thing,” he explains.

Moreover, with journey turning into extra accessible, extra individuals are selecting to journey for occasions just because they now can. Pablo Torres, hospitality marketing consultant and founding father of Torres Consulting, explains: “It’s not simply that extra occasions are taking place. It’s additionally as a result of extra folks can now afford to attend them.”

Maximising demand by dynamic pricing

The management of occasion provide by a handful of key gamers, mixed with a public extra desperate to journey than ever, has pushed lodges to show to know-how to seize this demand successfully. Income administration options providing market intelligence have been indispensable, and the necessity is obvious; lodges should depend on instruments that enable them to maintain monitor of demand round the clock, particularly for occasions attracting a extra world viewers.

“No human, no matter their expertise or ability, can assume sooner than a machine,” says Torres. “There are instruments available on the market that already present, for instance, the rise in searches and flights to your vacation spot, demand for bookings and the occasions you might need in your metropolis. You might try this manually and spend your complete day compiling the data, or you may press a button and have a dashboard in your display after which determine.”

With this data, improvements in resort tech have given properties the arrogance to enterprise into dynamic pricing, a technique wherein lodges modify room charges each day or throughout the day primarily based on real-time demand, permitting them to maximise occupancy and income throughout occasions. This technique has change into ubiquitous throughout industries – from airways to supply apps – and, as Klaus Kohlmayr, Chief Evangelist and Growth Officer at IDeaS, suggests, it’s excessive time that resort income managers embrace it absolutely, now that customers are extra conversant in the idea. Certainly, SiteMinder’s Altering Traveller Report 2025 signifies that greater than 6-in-10 travellers globally agree that lodges ought to be capable of modify their charges throughout peak demand durations.

“Relying on the kind of resort, you might see measurable income uplift simply by adopting dynamic pricing,” Kohlmayr explains. “From a client standpoint, dynamic pricing lets you pay a decrease price when demand is low, [in the same way] that you just settle for paying the next price when there’s excessive demand. Shoppers have been educated on that and so they perceive that [this strategy] occurs in companies everywhere in the world.”

Avoiding the pitfalls of value gouging

However regardless of the revenue-generating benefits that dynamic pricing gives, it usually attracts scrutiny. Sure ride-sharing companies have come underneath fireplace for value surges throughout public emergencies, whereas ticketing corporations have confronted backlash for dramatically inflating costs in response to high-demand occasions in current months. These cases have brought on the road between honest value changes and unethical value gouging to blur.

Shannon Knapp, Founder and Director of resort consultancy SKNapp Consulting, says: “Dynamic pricing is getting an unfair dangerous rap. A basic flaw in retail business purposes of dynamic pricing or demand-based pricing is once they don’t institute a cap or a ‘ceiling’ value level the best way we do in lodges, in order to forestall costs capturing as much as eleventy jillion {dollars} when Taylor Swift or Oasis broadcasts dates. The perfect resort income administration techniques have configurable ceiling settings to forestall this.”

Knapp provides: “In relation to dynamic pricing, income managers want to recollect: value gouging is exploitative and takes benefit of drawback, particularly throughout crises. Whereas value optimisation adjusts charges in response to high-demand leisure occasions with a ceiling price configured to make sure accountable software.”

This highlights the necessity for a considerate and data-based method to pricing, somewhat than merely reacting to fluctuating demand. Worth changes mustn’t solely reply to market circumstances but additionally contemplate how company understand the equity and worth of the charges supplied. Briefly, dynamic pricing isn’t nearly setting costs.

“Sadly, the ability set that now we have within the business thinks that dynamic pricing is like enjoying yo-yo by letting costs go up and down,” shares Bartnick. “Dynamic pricing is a tactical lever with many aspects at play. We have to perceive how our charges impression pricing energy, and our gross sales and advertising efforts.”

Worth-driven technique

Bartnick provides that the ‘lifetime worth of a buyer’ should even be factored in when finishing up dynamic pricing for occasions, preserving in thoughts loyal, repeat clients and even company from account-based shoppers. Balancing dynamic pricing for occasion clients with these long-term relationships permits lodges to seize quick income with out risking future enterprise from high-value company.

Importantly, on the core of dynamic pricing is the worth lodges can supply to company past the room. Whereas income managers could have the pliability to regulate their charges as soon as important demand from occasions is detected, their pricing methods needs to be paired with significant choices that present actual worth for cash.

Torres explains, “In case your solely supply is similar room that price 20 instances much less the day earlier than, most clients will discover it unfair. Why don’t you embody added worth? You’ll be able to create a bundle with the live performance organisers, embody transfers to the venue the place the occasion is happening or embody breakfast. Add worth in your pricing that company will discover significant, in order that they really feel they’re getting a good value.”

Agility at a time of uncertainty

The rise of occasion journey alerts a future that can solely see extra demand-driving developments impacting lodges, now that “the macroeconomic elements for hospitality and tourism are very constructive”, Kohlmayr factors out. “There are 100 million folks yearly which can be getting into the center class. In case you’re within the resort enterprise, you must take into consideration the long term alternatives to faucet into that.” This aligns with findings from SiteMinder’s Altering Traveller Report 2025, which reveals that 72% of travellers globally might be travelling internationally in 2025, and that the majority (92%) plan to spend a minimum of the identical quantity or extra on their lodging.

Nonetheless, as journey turns into much more dynamic, the business is anticipated to function in an more and more unsure atmosphere. On this regard, Bartnick emphasises that income managers need to be extra comfy with the uncertainty introduced by rising journey developments.

And, all of it begins with agility.

“Agility is the secret. We now have a sport the place we don’t actually know who’s enjoying or what the principles are. Airways have change into actually good at controlling provide of flights, very similar to how the Singaporean Authorities managed to regulate Taylor Swift’s tour location. In lots of cases, lodges might be on the receiving finish of those shifts. Some elements are outdoors your energy, but when they occur to be coming your approach, then you must be quick sufficient to monetise,” he says.

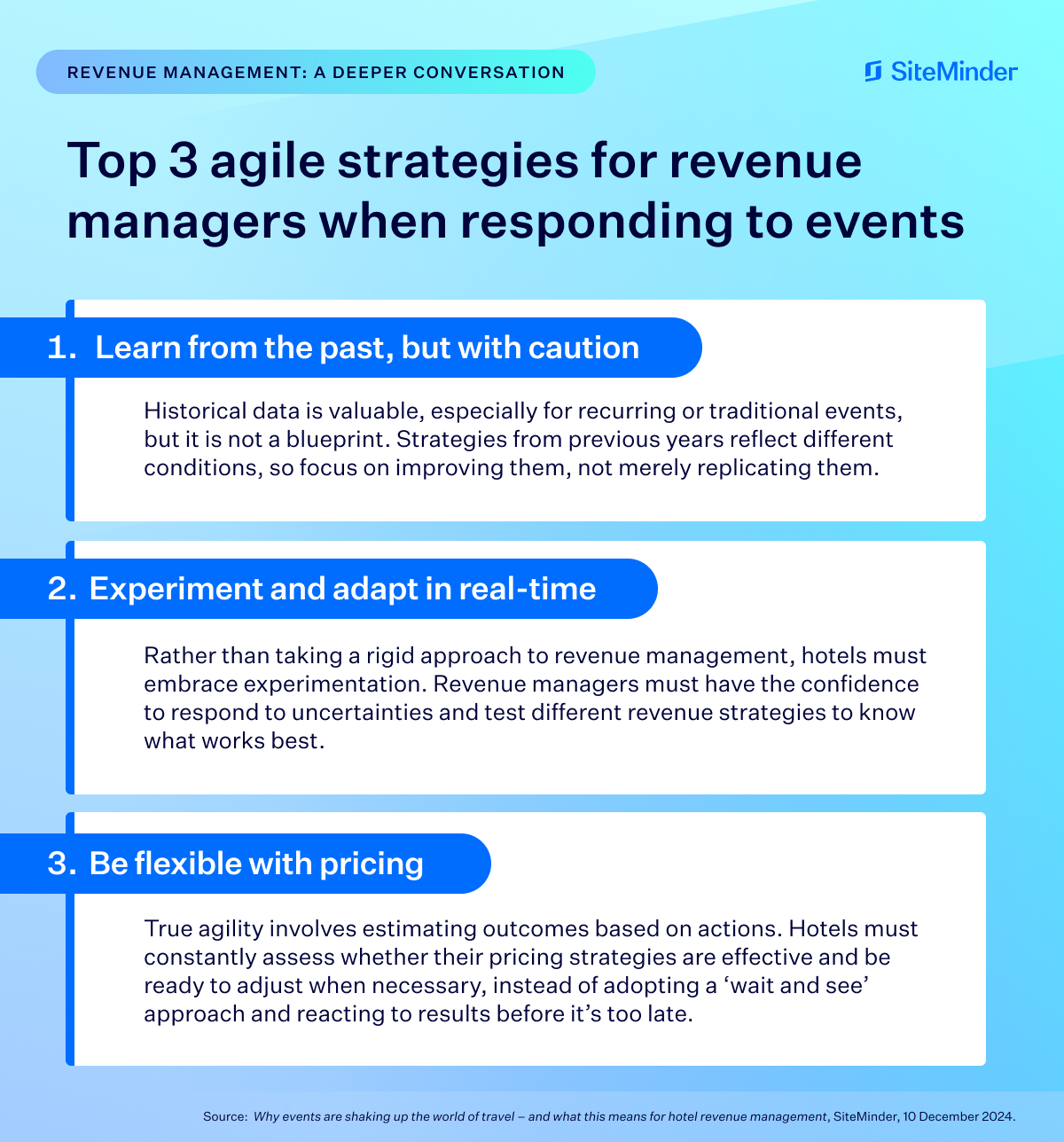

Income managers should then be extra reflective about their methods, significantly for unpredictable, high-demand occasions. Moderately than relying solely on historic knowledge or going by a inflexible ‘wait and see’ method, altering pricing selections when it’s too late, they should set expectations even earlier than they set their income methods and usually re-evaluate their selections.

“We’re not taking a look at trigger and impact in the meanwhile when setting dynamic pricing methods,” notes Bartnick. “We don’t assume forward – that if I throw a ball at a sure velocity, it’ll come again in a selected spot.”

He provides, “That’s why we have to do [away with] that basic, inflexible mindset in income administration and change into extra agile, extra experimental. Nothing is created within the consolation zone. Income administration itself is a subject of experimentation.”

[ad_2]